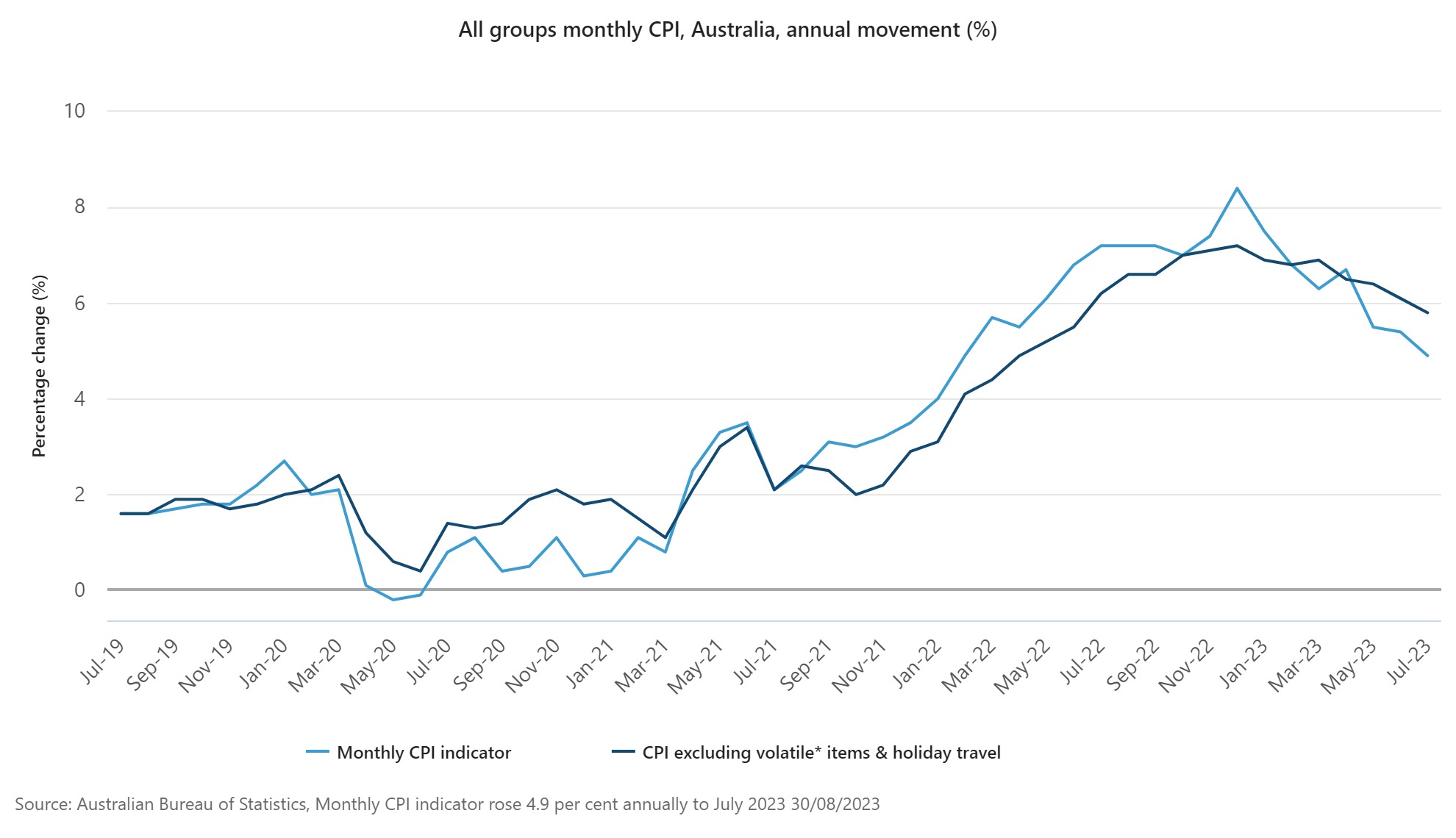

The monthly Consumer Price Index (CPI) indicator rose 4.9% in the 12 months to July 2023 down from 5.4% in June, according to the latest data from the Australian Bureau of Statistics (ABS).

However, it remains to be seen whether the latest inflation data will have any effect on the official cash rate, which will be decided at the next RBA board meeting next Tuesday, September 5.

Michelle Marquardt (pictured above), ABS head of prices statistics, said annual price rises continue to ease from the peak of 8.4% in December 2022.

“CPI inflation is often impacted by items with volatile price changes like automotive fuel, fruit and vegetables, and holiday travel. It can be helpful to exclude these items from the headline CPI indicator to provide a view of underlying inflation,” Marquardt said.

When excluding these volatile items, the decline in annual inflation is more modest at 5.8% in July, compared to 6.1% in June.”

It was again the usual suspects, housing and electricity, that drove inflation.

However, the annual increase for housing of 7.3% was slightly lower than the 7.4% increase in June.

New dwelling prices rose 5.9%, which is the lowest annual rise since October 2021, as building material price increases continued to ease. Rent prices rose 7.6% in July, up from 7.3% in June, as the rental market remains tight.

Electricity prices rose 15.7% year-on-year and rose 6% in just the month of July.

These increases reflect price reviews across all capital cities. Rebates introduced from July reduced the impact of electricity price increases for eligible households.

“The Energy Bill Relief Fund provides eligible households with rebates ranging from $43.75 to $250 in July. If we exclude the impact of rebates from the July 2023 figures, electricity prices would have recorded a monthly increase of 19.2%,” Ms Marquardt said.

Food and non-alcoholic beverages (+5.6%) was also among the highest contributors of inflation while there were price falls for automotive fuel (-7.6%) and fruit and vegetables.

“Food inflation continues to ease across most categories, while fruit and vegetable prices fell 5.4 % compared to 12 months ago due to favourable growing conditions leading to increased supply,” Ms Marquardt said.

While there is still no definitive way to know whether the RBA will raise the official cash rate or keep it paused for a third consecutive month, the decision is less on a knife-edge when compared to previous months.

Inflation is generally tracking down towards the RBA’s target band of 2%-3% and the RBA’s previous wording had indicated a shift towards stability in previous months.

While the verdict is split on the cash rate’s peak, with ANZ, Westpac, and CBA say 4.10% is as high as interest rates will go while NAB predicts one more 25-basis-point hike, it’s unanimous among the big four that it won’t rise in September, according to Mozo.

NAB forecasts the rate rise to hit by December 2023, bringing the cash rate up to 4.35%, until it slowly declines over next year.

At least this is the case at the time of writing with the bank’s known to re-evaluate their forecasts after the inflation data in previous months.