Nearly all of the country’s big banks slashed their advertised fixed mortgage rates this week, in some cases by as much as 70 basis points (or 0.70%).

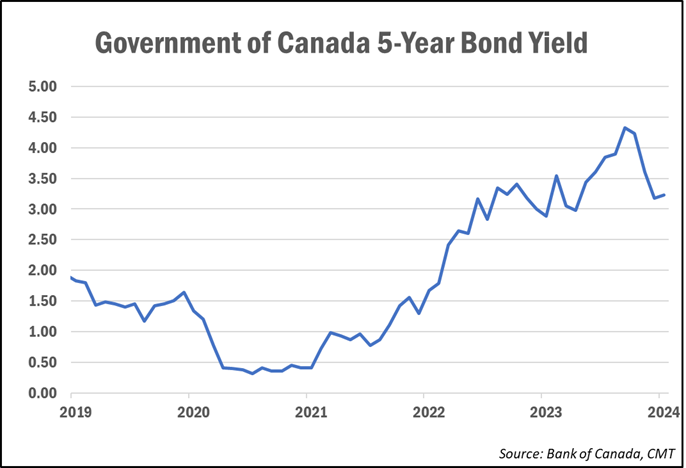

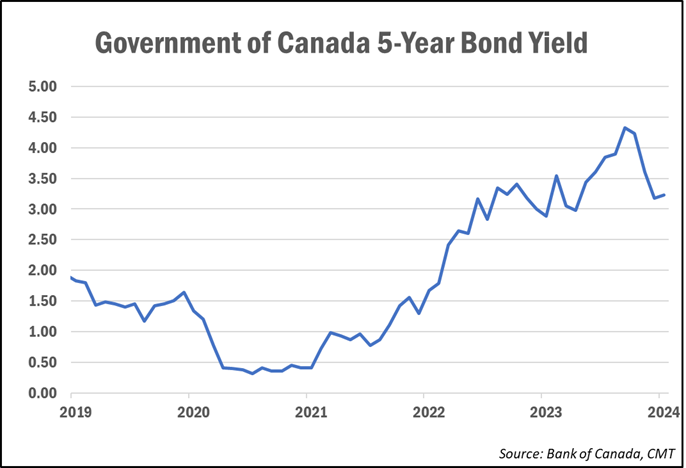

As we reported last month, countless lenders have been dropping fixed mortgage rates to bring them in line with funding costs following a sharp decline in bond yields, which lead fixed mortgage rate pricing.

This week, most big banks, as well as HSBC, reduced rates across all mortgage terms, including advertised 5-year rates, with insured (those with a down payment of less than 20%) averaging 5.24% and uninsured at around 5.65%.

However, we hear that well-qualified clients at select banks are being offered high-ratio 5-year rates as low as 4.99% if they are closing in the next 30 days.

Other mortgage lenders have also been busy dropping rates, including some online deep-discount brokers. As of Friday, Butler Mortgage was offering the lowest insured 5-year fixed rate of 4.69%, although that’s not available in all provinces.

Ron Butler told CMT that the rate involves no restrictions or hidden penalties. For those wanting a shorter term, Butler also currently has the lowest high-ratio 3-year fixed, now priced at 4.99%.

Rates have been falling steadily since October, mirroring the decline in Government of Canada bond yields, which have fallen over a full percentage point since peaking in early October.

Observers say the latest rate move by all of the big banks this week is simply to bring their pricing in line with the current level of bond yields.

“Rate cuts are all due to the spread being so high for so long I think,” Ryan Sims, a TMG The Mortgage Group broker and former investment banker, told CMT. “They were raking it in, and bond yields had stayed down for so long, they needed to adjust.”

However, should yields start to trend back up, Sims said borrowers shouldn’t rule out the possibility that rates trend higher again.

While fixed rates could continue to fall further, at least one rate expert noted that bond yields—upon which fixed mortgage rates are priced—are foward-looking and have fallen in anticipation of monetary policy loosening later this year. As a result, further fixed-rate cuts going forward could be limited.

“Our current fixed mortgage rates have already priced in substantial rate cuts by the U.S. Federal Reserve and the BoC in 2024,” Dave Larock of Integrated Mortgage Planners wrote in a recent blog post. “That reduces the potential for further decreases.”

Variable mortgage rates, which are currently priced anywhere from 100 to 150 basis points above comparable fixed rates, are expected to fall throughout the year as the Bank of Canada delivers anticipated rate cuts.

“Anyone choosing a variable rate today must believe that their rate will fall below today’s available fixed rates, and with enough time left on their term to recoup the higher initial cost plus some additional saving,” Larock noted.

“That means rates would have to start falling substantially, and relatively soon,” he added. “I expect both things to happen.”

Bond markets are currently pricing in a 74% chance of a quarter-point rate cut at the Bank’s March meeting, and a 30% chance of an additional 50 bps in June. By September, markets see a 64% chance of 100-bps worth of cuts to the current benchmark rate of 5.00%.

“If you’re in the market for a mortgage today, variable rates are worth considering if you can tolerate payment risk and are prepared to be patient,” Larock wrote.

For those not willing to take on the risk of a variable-rate just yet, Butler says a 1-year fixed rate is “optimal” right now as it buys borrowers time to reassess the rate environment in 12 months.

“For those renewing and who may have payment concerns, take a 3-year fixed to get a better rate,” he suggested.